Most senior citizens know about the Grandma telephone scam when a caller poses as a grandson. Telling a troubled tale, he tries to extract emergency money from his target.

I’ve had calls like this, but the voices are far too old to be one of my grandsons, and I just laugh and hang up.

But elder fraud is no laughing matter and — to my horror — the FBI has defined those of us 60 and up not only as elderly but also prime targets for scammers.

I learned this terrible truth from two FBI agents who presented a program at the Riegelsville Borough Hall. Visiting from the bureau’s Allentown office, the pair’s goal was to alert those attending about the growing menace. The agents said people over 60 tend to be retired, more frequently at home, more polite, more willing to listen and probably have more access to cash or even the gold bars scammers may demand.

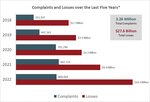

It has become so widespread the U.S. Department of Justice and other agencies have created the Internet Crime Complaint Center (www.ic3.gov) and it showed a marked (11%) increase in elder fraud just last year.

The agents, a man and a woman who insisted on anonymity, said 101,000 victims reported losses of almost $3.4 billion to IC3 in 2023. (And those numbers account only for crimes reported.) The average loss exceeded nearly $34,000; more than 5,900 victims were parted from more than $100,000 each.

The agents said the growth of artificial intelligence will only exacerbate the problem, allowing newer forms of deception. To be safe, people should never send or wire anything to a person they do not know, they warned.

The schemes, according to the FBI, often are romance scams victimizing the lonely and gullible, and usually related to social media or dating websites.

Other seniors are often not tech-savvy and these scams are worked by so-called technical support people who conjure up nonexistent issues to capture personal information from the victim’s computer.

Grifters sometimes pose as government officials, often frightening and demanding immediate payment from their victims and threatening prison for some mythical infraction.

With a sweepstakes, lottery or inheritance scam, the criminals demand payment of fees and taxes before the money can be released to the recipient.

Investment and charity scams are as old as the hills and even more effective when handled by a slick telephone criminal.

The FBI agents also warned not to be surprised if the people after their money are caregivers or even family members. Sadly, that does happen.

The agents offered the following tips to avoid becoming a victim:

• Never provide any personal information to an unknown caller.

• Be cautious of any unsolicited phone calls, mailings and door-to-door offerings.

• Scammers try to create a sense of urgency, so resist the pressure to act quickly.

• Never wire money to people or businesses you have only met online and verify any email requests for money.

• Make sure your computer’s antivirus and security software is up to date. If you receive a pop-up or locked screen, disconnect from the internet and turn off. The agents also suggest taking your device to a computer store to be sure no malware has been placed on it.

• Do not open any emails or click on any attachments or links you don’t recognize or are not expecting.

• If the caller is pushing a certain product, research it online first to find out if it’s legitimate.

• If you expect someone is trying to scam you, stop communicating with them, but know they may continue to contact you.

If you think you or someone you know is a victim or potential victim of elder fraud, file a complaint with www.ic3.gov.

Kathryn Finegan Clark is a freelance writer who lives in Durham Township. She can be reached at kathyclark817@gmail.com.

Join our readers whose generous donations are making it possible for you to read our news coverage. Help keep local journalism alive and our community strong. Donate today.